When it comes to your financial goals, you deserve tools that meet you where you’re at.

And if you’re one of the many Canadians living with a disability—whether it’s visible or invisible—daily life can involve additional costs and barriers that others may not see. From healthcare and equipment to the extra time and effort it takes just to navigate the world. These expenses add up. Advocates say the poverty line for people with disabilities is roughly 30% higher than the standard poverty line, due to these hidden costs.

Enter the Registered Disability Savings Plan (RDSP). It’s one of the few times the government might give you money to help to save for your own long-term financial goals.

Even if acronyms make your eyes glaze over, this tool is too good to ignore.

The RDSP isn’t just about money. It’s about independence, stability, and peace of mind. With top-ups from the government, your savings can grow faster, and your future can feel a little more in your control.

Aymara Castillo Alvarez, a Wealth Planner with Vancity and Aviso Wealth, sat down with us to discuss the 2025 RDSP in Canada. Aymara breaks down who the RDSP is for, how to get started, and why the RDSP matters.

The RDSP isn’t just about money. It’s about independence, stability, and peace of mind. With top-ups from the government, your savings can grow faster, and your future can feel a little more in your control.

The RDSP isn’t just about money. It’s about independence, stability, and peace of mind. With top-ups from the government, your savings can grow faster, and your future can feel a little more in your control.

The RDSP is more than a savings plan. It’s a gateway to independence and peace of mind.

So, what exactly is a Registered Disability Savings Plan?

The RDSP is a savings plan built for Canadians who are eligible for the Disability Tax Credit. At its core, the RDSP is designed to help Canadians with disabilities save for the future. That includes nearly 8 million people, each with unique needs. Whether you’re managing your own finances, supporting a loved one, or planning for long-term care, the RDSP can offer flexible, meaningful support.

Think of the RDSP like a savings plan with built-in boosters. The government can add up to $3,500 in grants each year, or potentially up to $10,500 if you’ve been eligible in previous years but haven’t yet contributed. And you don’t always need to contribute yourself to benefit from those grants.

“The RDSP matters because it’s one of the most powerful savings tools available to people with disabilities in Canada,” says Aymara. “It’s designed specifically to help build long-term financial security, and in many cases, the government will contribute far more than the individual does. For low- and modest-income families, this can be life-changing. It’s not just a savings plan—it’s a gateway to independence and peace of mind.”

RDSP highlights, in a nutshell.

The RDSP will work for you. It can:

- Net you some free money. See below for the government grants and bonds.

- Let your money grow tax-sheltered. With an RDSP, your contributions grow tax-free but government grants/bonds and earnings are taxed as income when you take them out.

- Let others contribute to your account.

- Keep your other benefits intact. The RDSP won’t affect your Old Age Security or Guaranteed Income Supplement or other federal income tested benefits.

- Can be immune to certain clawbacks. RDSP grants and bonds follow the 10-year repayment rule, but other benefits may stay untouched. In BC, RDSPs don’t count against disability assistance limits, and RDSP withdrawals don’t count against disability assistance income limits.

- Give you the peace of mind that comes with financial stability.

Over time, even small contributions can compound significantly. And withdrawals can be structured to avoid penalties or clawbacks, so you don’t need to worry about losing your disability benefits.

“The earlier you start, the more opportunity there is to maximize government grants and bonds, and to benefit from compound growth.” Aymara Castillo Alvarez, Wealth Planner with Vancity at Aviso Wealth.

More on that “free money” from the RDSP, AKA government grants and bonds.

Quick math: You could receive up to $90,000 in combined grants and bonds over your lifetime. That’s free money from the government, which is the best kind of money.

If you’re eligible, the government will add to your savings through two programs: The Canada Disability Savings Grant and Bond.

“A big misconception with the RDSP is that you need to contribute a lot of money to benefit from it,” says Aymara. “In fact, even if you don’t contribute anything, low-income individuals may still qualify for the Canada Disability Savings Bond, which can add up to $1,000 per year (up to a lifetime max of $20,000). That’s free money for eligible individuals.”

The Canada Disability Savings Grant.

With the Canada Disability Savings Grant, the government matches your contributions, sometimes by up to three times.

- If your family net income is $114,750 or less, you can get up to $3 grant for every $1 you contribute, on the first $500, and $2 for every $1 on the next $1,000 contribution. That’s a maximum of $3,500 per year in free grant money.

- If your family net income is over $114,750, you’ll get a 1-to-1 match, up to $1,000 per year.

The Canada Disability Savings Bond.

The Canada Disability Savings Bond doesn’t require any contributions at all! That means you just have to open it to start receiving money.

- If your family net income is $37,487 or less, you can receive $1,000 per year, even if you don’t put in a single dollar yourself.

- If your family net income is between $37,487 and $57,375, you may receive a partial bond. The amount decreases as income rises.

“The RDSP is uniquely powerful because of the matching grants from the government,” says Aymara. “For families that are struggling, this is a good opportunity to receive funding that grows tax-deferred.”

Starting early can make a six-figure difference.

What’s the biggest financial benefit of getting started with an RDSP early? “Time,” says Aymara. “The earlier you start, the more opportunity there is to maximize government grants and bonds, and to benefit from compound growth.”

“The earlier you start, the more opportunity there is to maximize government grants and bonds, and to benefit from compound growth.” Aymara Castillo Alvarez, Wealth Planner, Vancity at Aviso Wealth

Let’s break that down a little.

Compound interest helps your money grow faster over time because you earn interest not just on your original amount, but also on the interest it earns along the way. It’s like a snowball rolling down a hill, each turn adds more snow, making it grow bigger, faster. The longer you leave your money invested, the more time it has to build on itself.

“Since the government will match up to $3,500 in grants annually (depending on income), -starting young can make a six-figure difference by retirement age,” says Aymara. “Plus, there’s a 10-year vesting period on the grants and bonds, so starting earlier helps ensure you can keep those funds later on.”

The 10-year vesting period simply means you need to let that money sit for 10 years to access the entire amount.

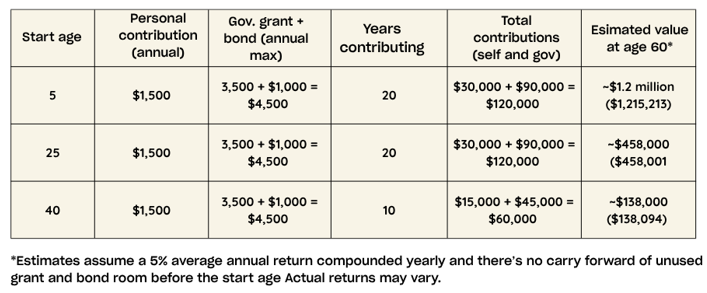

Here’s what compound growth could look like, based on full eligibility and contributing $1,500 annually.

- If you start contributing $1,500 a year at age five and qualify for the full government grant and bond of up to $4,500 annually, your savings could grow to around $1.2 million by age 60.

- Start at age 25 with the same annual contributions? You could end up with around $458,000.

- Even starting at age 40 with 10 years of contributions and a lower grant and bond cap of $3,500 annually, your savings could still grow to about $138,000 by age 60*.

This table breaks it down:

What you can contribute and how much the government will give you based on your income can change year to year. It’s always worth checking out the latest numbers.

Who’s eligible for the RDSP?

According to the Government of Canada, there are four things you must meet to open an RDSP:

- Be approved for the Disability Tax Credit.

- Apply before December 31 of the year you turn 59.

- Be a resident of Canada.

- Have a Social Insurance Number (SIN).

Now, three of those things are pretty simple. Getting approved for the Disability Tax Credit (DTC) can be a bit tricky, even though applying for it isn’t too hard.

“Don’t assume you don’t qualify,” says Aymara. “The criteria for the DTC can be misunderstood. It’s not just about whether someone uses a wheelchair or receives assistance every day. It can include conditions like ADHD, autism, chronic illnesses, or mental health conditions that affect daily living.”

If you’re unsure if you qualify, ask! “Reach out to a professional or a support organization that understands the system. They can often help clarify whether an application is worth pursuing,” says Aymara.

You don’t need to be an expert on the DTC or RDSPs to benefit from them. “It can feel like a lot at first. I always tell people to: start small. You don’t have to understand every detail right away,” says Aymara. “You don’t have to do it alone. There are organizations and people— like me—who are here to help. The most important thing is to just get started.”

How to apply for the RDSP.

Your first step is to qualify for the DTC. That’s what opens the door to the RDSP.

“The most common hurdle is navigating the DTC process,” says Aymara. “It can be overwhelming, especially for folks with invisible disabilities or fluctuating conditions. Support from organizations like Plan Institute or local advocacy groups can make a huge difference.”

Once you’re approved for the DTC, you can head into any financial institution that offers the RDSP—like Vancity—to open an account. When you open an RDSP, you can apply for the Canada Disability Savings Grant and Savings Bond.

And, as of 2021, you’re no longer required to be eligible for the DTC every year to keep your RDSP. “Even if someone loses their DTC status, their RDSP doesn’t have to be closed,” says Aymara. “That’s a huge relief for families who were living with uncertainty.”

Your first step is to qualify for the Disability Tax Credit. That’s what opens the door to the RDSP.

What getting started can look like: Aymara’s first RDSP client.

Getting started might feel intimidating, but people like Aymara are here to help you.

Aymara remembers her very first RDSP appointment. “I’ll admit, I felt a little overwhelmed,” says Aymara. “My knowledge was basic, and the paperwork all had to be completed manually. But I was ready to help, and the experience turned out to be one of the most rewarding of my career.”

Aymara’s client was a single mother with disabilities who had two children with disabilities as well. She’s a full-time caretaker for the children and couldn’t work outside the home. The idea of tackling the paperwork felt impossible.

“She described the process as overwhelming, and I understood why,” says Aymara. “I prepared carefully. I reached out to colleagues and did my homework ahead of time so I could guide her through each step with confidence. I wanted to make sure the process was as simple and stress-free as possible.”

And in the end, that’s exactly what happened. Aymara started by opening an RDSP for the mother. Then, one of her children, who was already approved for the DTC, got their own plan. The third is in progress.

“She was so relieved to have someone by her side. What once felt impossible turned into something manageable,” says Aymara. “Since then, she’s been contributing to her RDSP and already receiving government grants.” Aymara’s client felt empowered and hopeful, and confident that this plan was a step toward a more secure future for herself and her children.

“That first RDSP was just the beginning,” says Aymara. “Every time I help someone open one, it’s a reminder of how impactful this program can be. The RDSP is more than just a savings account—it’s a pathway to independence and peace of mind for families navigating the challenges of disability.”

RDSP support is out there.

If you’re overwhelmed, don’t get discouraged. There are trustworthy resources out there to help you specifically with the RDSP.

Aymara recommends three resources that offer reliable, free support to help you make the most of the RDSP.

- Plan Institute, which runs a free national RDSP Helpline (1-844-311-7526) and offers webinars, online tools, and a helpful RDSP calculator.

- The Access RDSP partnership includes the abovementioned Plan Institute, Disability Alliance BC (DABC), and the BC Aboriginal Network on Disability Society (BCANDS). This partnership provides one-on-one assistance, including help with DTC applications and setting up RDSPs.

- The Government of Canada’s official RDSP page is the best place to start for general information and government assistance, such as grants and bonds. You can also call Service Canada or the Canada Revenue Agency directly with questions

The best time to start is now.

Opening an RDSP isn’t just about saving, it’s about unlocking opportunities.

“Don’t wait. Even if you’re not ready to contribute money yet, opening an RDSP gets the clock ticking on eligibility for grants and bonds,” says Aymara. “You’re not alone in this. There are great people and programs across Canada ready to help.” And financial institutions, like Vancity.

You deserve financial tools that support your future. Connect with a Vancity advisor like Aymara to open an RDSP or simply learn more about your options. One small step today is one giant leap for peace of mind tomorrow.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this article is from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is not intended to be investment, tax or other advice and should not be relied on without seeking the guidance of a professional to ensure your circumstances are properly considered. Please see our Terms of Use.