For many investors, socially responsible investing (SRI), isn’t just something that is “nice to have” in an investment portfolio; it’s a guiding principal behind all their investment decisions.

Others, however, point to a prevailing myth that says if one invests their money in companies that do good they must sacrifice potential returns.

This simply isn’t the case. You do not have to sacrifice good returns in order to support environmental and social causes. In fact, research shows that SRI can stimulate a largely neutral (and often positive!) financial performance.

Think about it this way: SRI is an investment approach that considers environmental, social and governance (ESG) risks when choosing which companies to invest in. That means that these companies:

- E (for environmental): Avoid operations that have a significant negative impact on air, land, water and human health;

- S (for social): Think about the impact they can have on society by addressing matters such as human rights, supply chains, worker safety and aboriginal rights; and

- G (or governance): Operate transparently and are accountable regarding corporate risk management and executive compensation.

Risky business

You’ve likely heard about companies involved in oil spills, worker exploitation, anti-competitive behavior and unusually high executive compensation. These risky business practices can have a negative impact on your investments. It makes sense then that because of their commitment to doing better, companies with high ESG scores have greater potential for long-term performance than those that may not be as socially responsible.

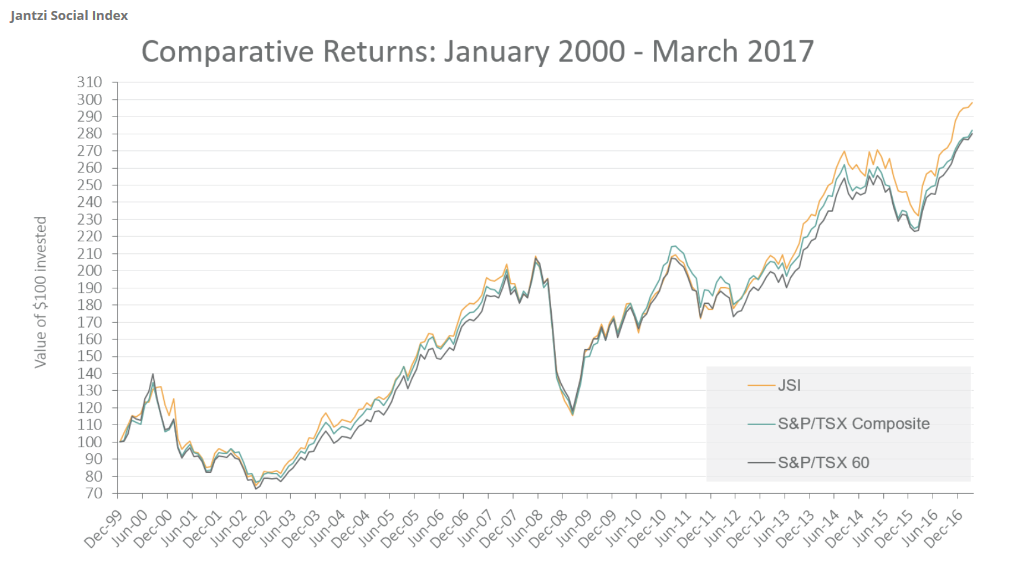

And the statistics prove this is the case. The Jantzi Social Index is a socially-screened, market capitalization-weighted common stock index made up of Canadian companies. In layman’s terms, it shows that socially responsible investments deliver returns that are equal to, or greater than, traditional investments.

Source: Sustainalytics

It is possible, after all, to feel better about where you invest your money.

Fun disclaimer alert:

This blog post provides general information only, and does not constitute financial, accounting, tax, legal or other professional advice. We encourage you to obtain personalized advice from qualified professionals regarding your particular circumstances. Please see our Terms of Use.